How to ask for warm intros? How to write a warm introduction email? Who is the best person to ask for an investor intro? How to grow your network and find referrers?

Ask anyone, "What is the best way to get meetings with investors?" They'll reply: warm introductions.

Warm intros can get you a meeting with any investor on the planet. Both VCs and angels are infamous for being adamant about warm intros.

Warm introductions help you start your relationship with investors on the right foot. It accelerates your fundraising and increases the odds of getting funded.

What is a warm introduction?

A warm introduction is when someone an investor knows introduces you to the investor. Usually, the introducer (referrer) is a startup founder.

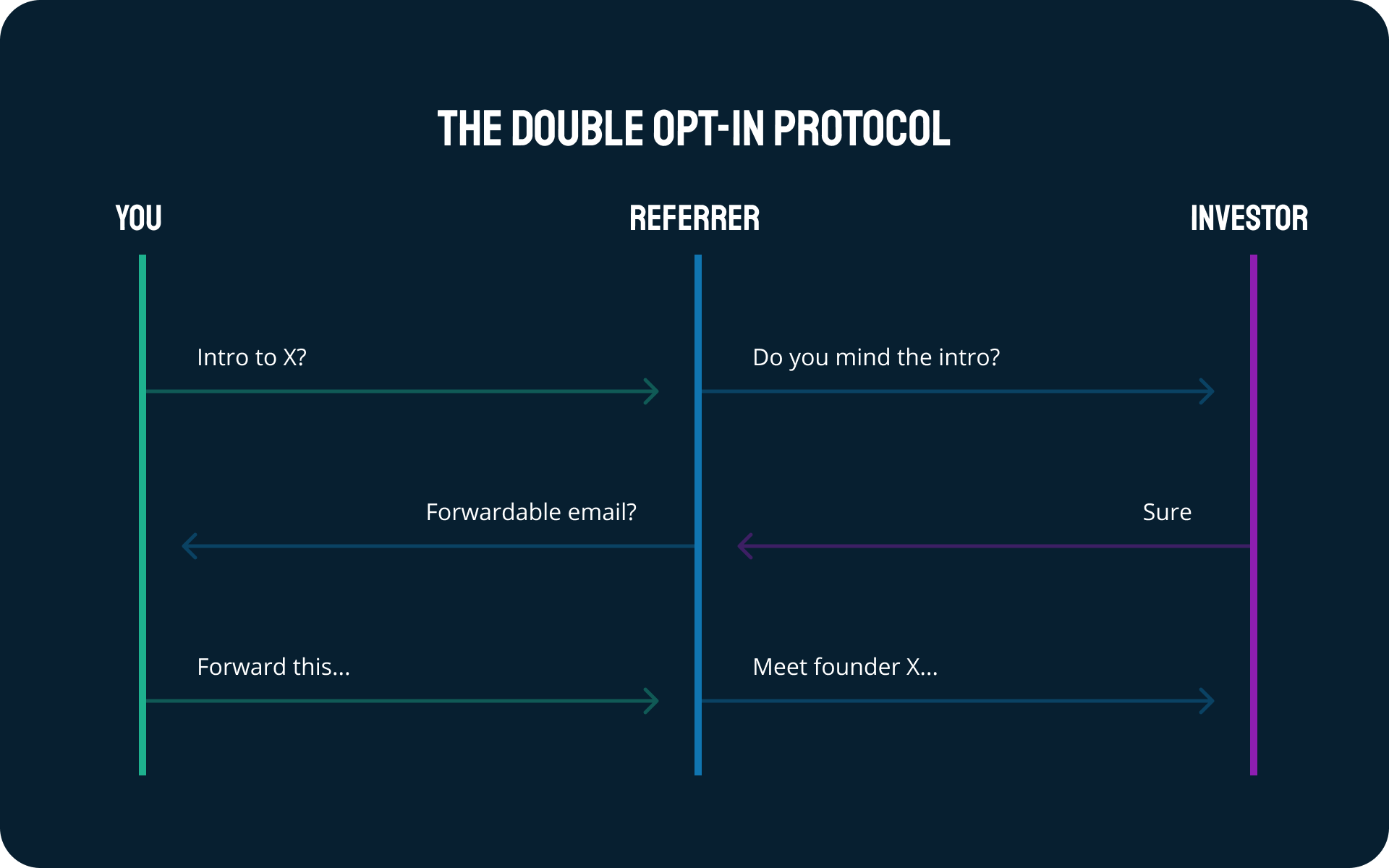

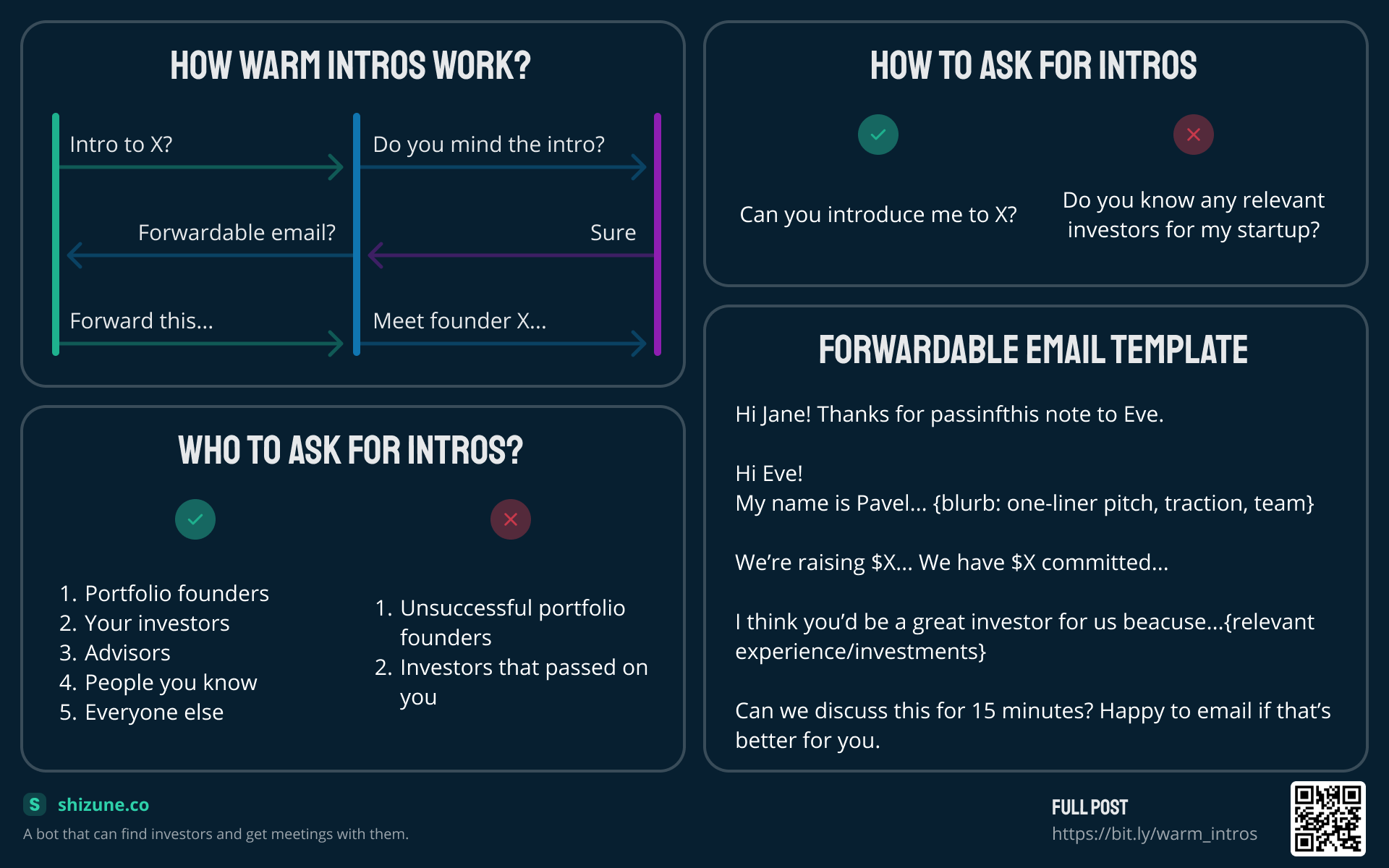

How do warm introductions work?

- You ask a referrer to introduce you to an investor.

- The referrer asks the investor if she/he doesn't mind the intro.

- If the investor is positive about the intro, the referrer gets back to you to confirm that you're ready for the introduction.

- The referrer then connects you and the investor in an email thread.

- You thank the introducer, greet the investor, and schedule the meeting.

It's called the double opt-in protocol:

When introducing two people who don't know each other, ask each of them to opt-in to the introduction before making it.

Who is the best person to ask for an investor intro?

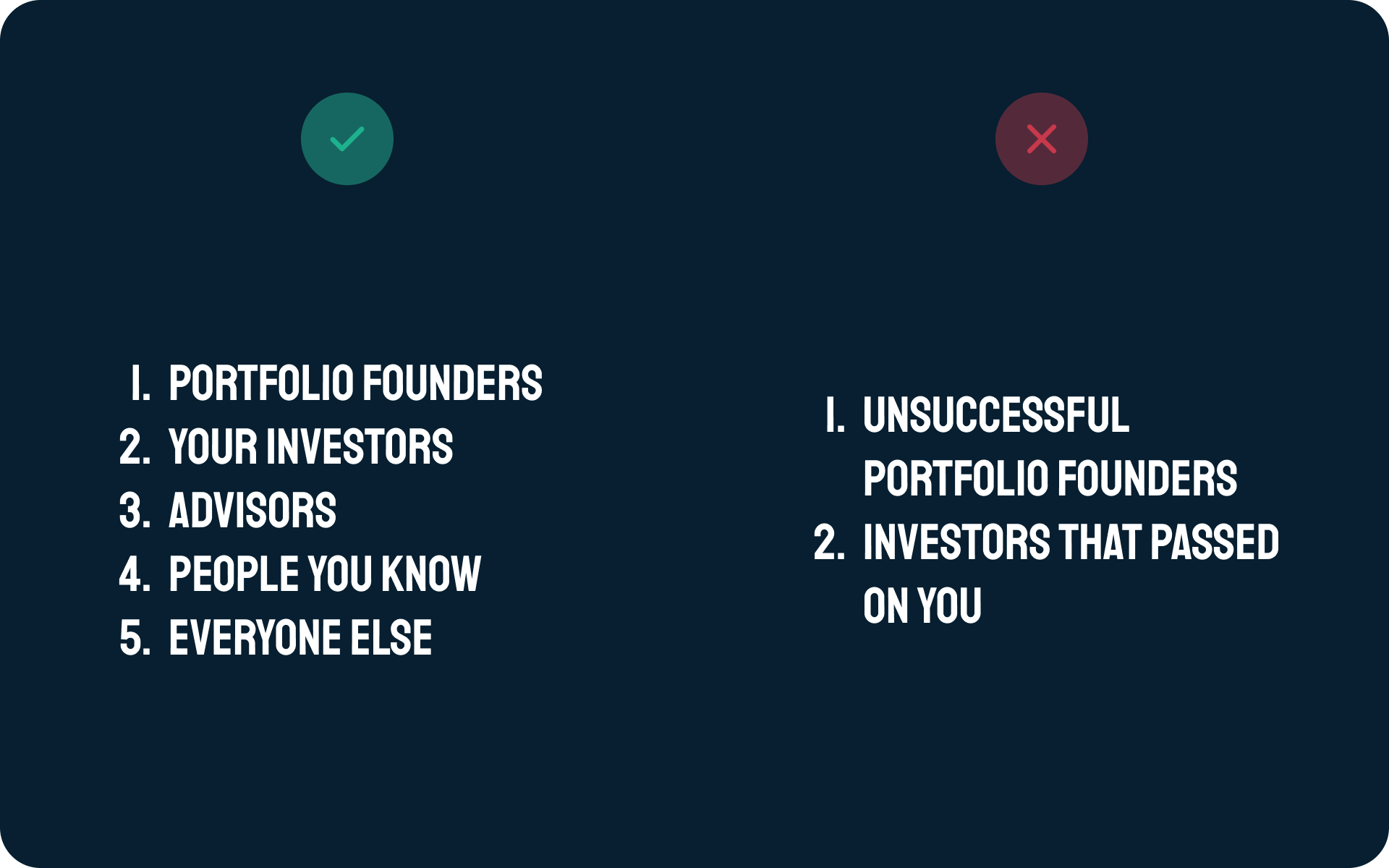

Not all introductions are equal. The success of an introduction highly depends on WHO made the intro. It should be someone an investor knows, trusts, and respects.

Top referrers:

- Portfolio founders (founders who raised money from the investor). These are the best possible introducers. The investor trusts them so much that she/he invested in them!

- Your investors/advisors. They signal to other investors that your company is worth investing in. Especially if your investors are industry experts. You can ask for intros not only your old investors but also investors who joined your current round.

- People you know in person. These people know you and your company well enough so they can advocate for you. Ideally, they should be founders.

- Everyone else. Asking for intros people you barely know might work, but it's risky. You don't know what the investor thinks about them. And you don't know what these people think about you and your company. But if you don't have other options left, it may be your last resort.

Avoid introductions from these people:

- Unsuccessful portfolio founders. The burned the investor's money.

- Investors that passed on you. They will send a wrong signal to other investors. The other investors will think: "If the company is that good, why you passed on them?"

Elizabeth Yin wrote a fantastic article on warm intro referrers. Check it out for more on this.

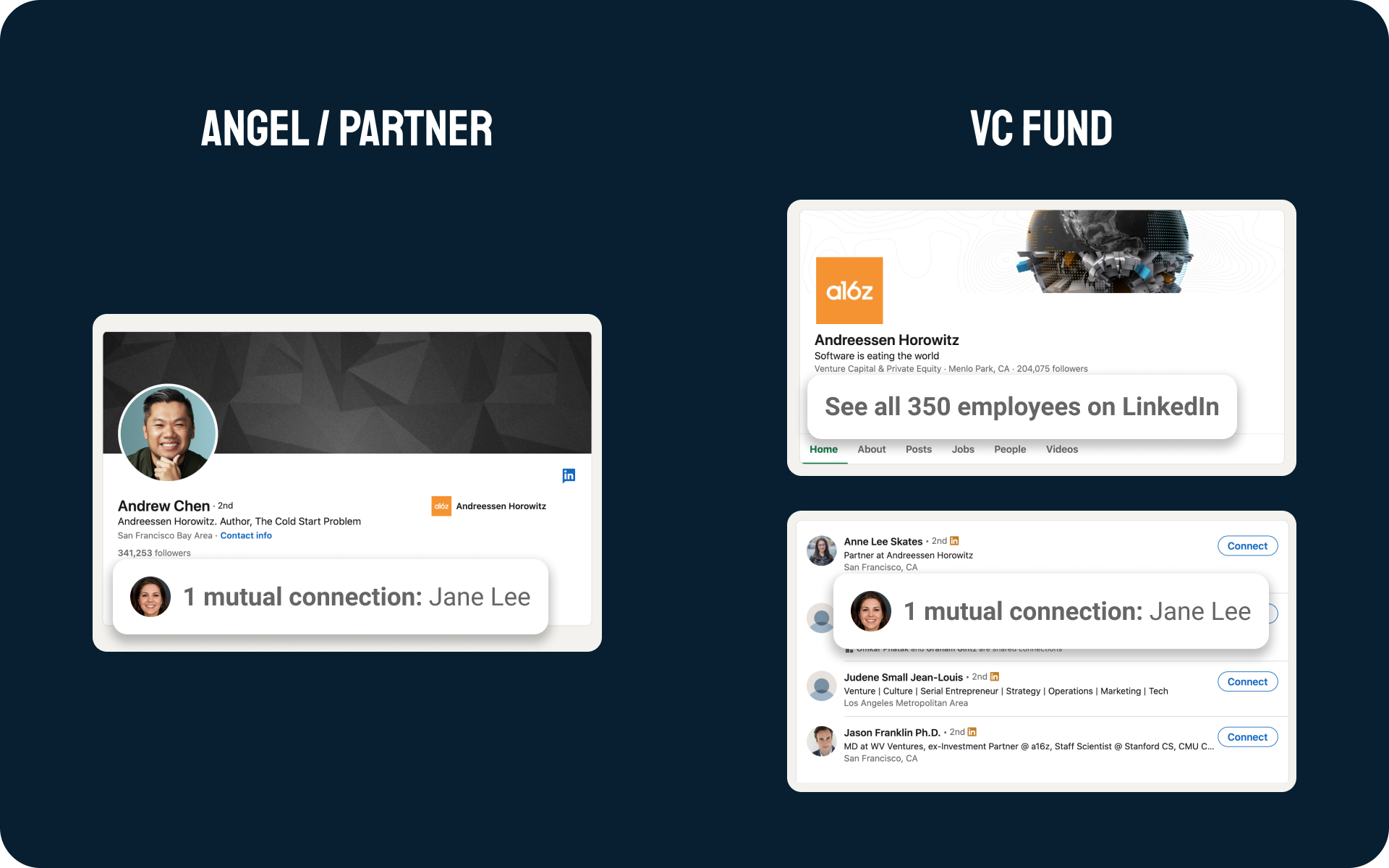

How to find introduction paths to an investor?

Repeat this for all investors in your funnel.

- Open an investor's profile on LinkedIn.

- Check for mutual connections.

If you want to connect with a VC fund:

- Open the fund's profile on LinkedIn.

- Go to the employees page.

- Write down all VC partners with mutual connections.

- Research them all and pick the one who is investing in your industry at your stage.

If you don't have a list of target investors — build it. This is essential if you want to run a tight fundraising process. Read how to find relevant investors for your startup here.

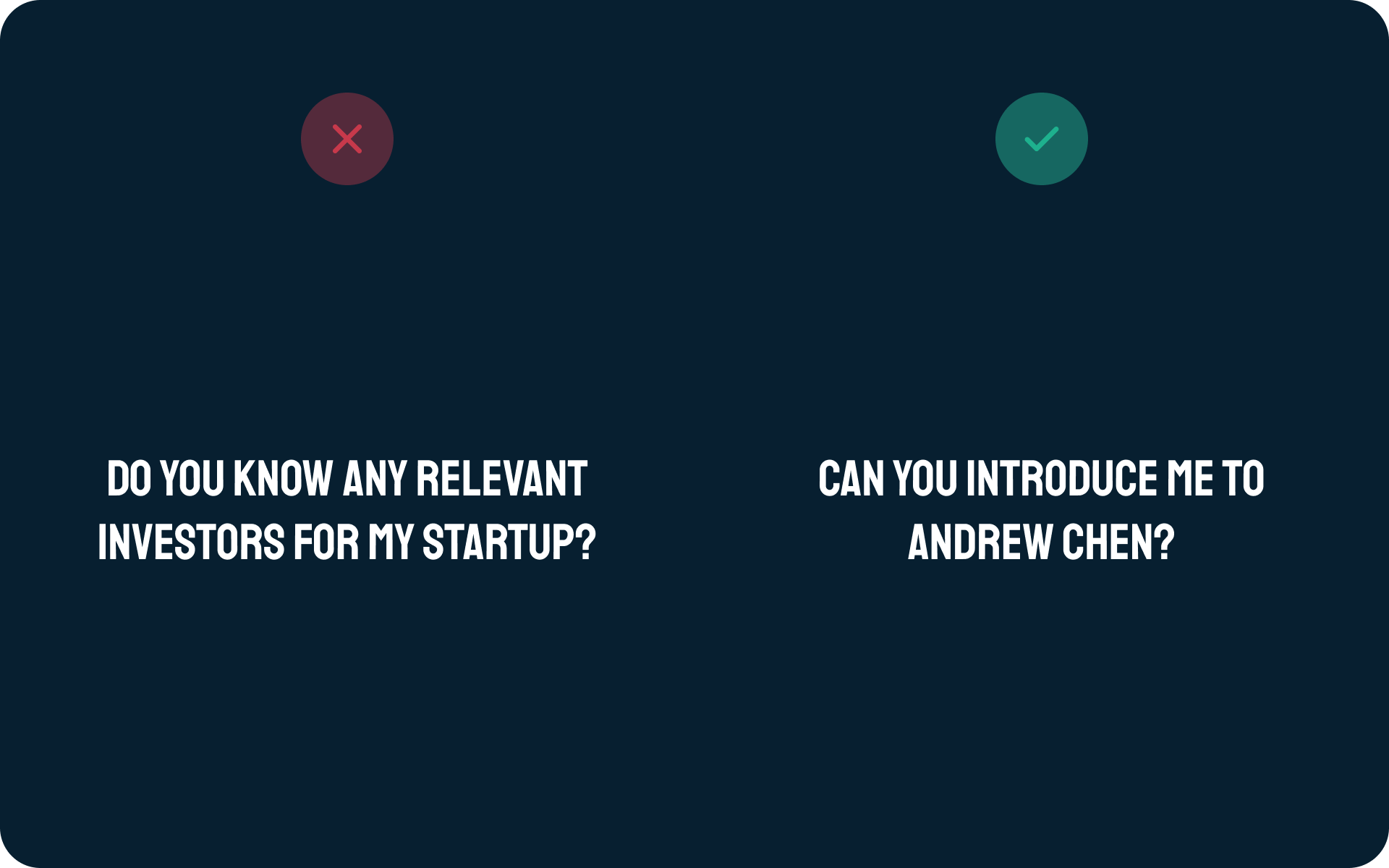

How to ask for an investor intro?

There are two ways to ask for a warm introduction:

- Ask about an introduction to a specific investor (investors). It looks like this: "Can you introduce me to Andrew Chen from A16Z?"

- Ask if they can recommend you someone. Usually, it goes like this: "Do you know any relevant investors for my company?"

Always ask for an intro to a specific investor. Do not ask for recommendations.

Make it as easy as possible to make intros for you. Otherwise, they won't do it because they have no time to do free work for you.

If you ask me if I can introduce you to a specific investor, it's easy for me to answer. It is either yes or no.

But when you ask me if I know any good investors for your startup... I just can't answer this question. I don't know anything about your startup. I don't know what investors you're looking for. It's your job to find investors for your startup.

There is one exception. You can ask your co-founders, investors, and advisors for investor recommendations. They have enough context and motivation.

How to write a warm introduction email?

Provide your referrers with all the necessary details, and you'll get 3x more intros.

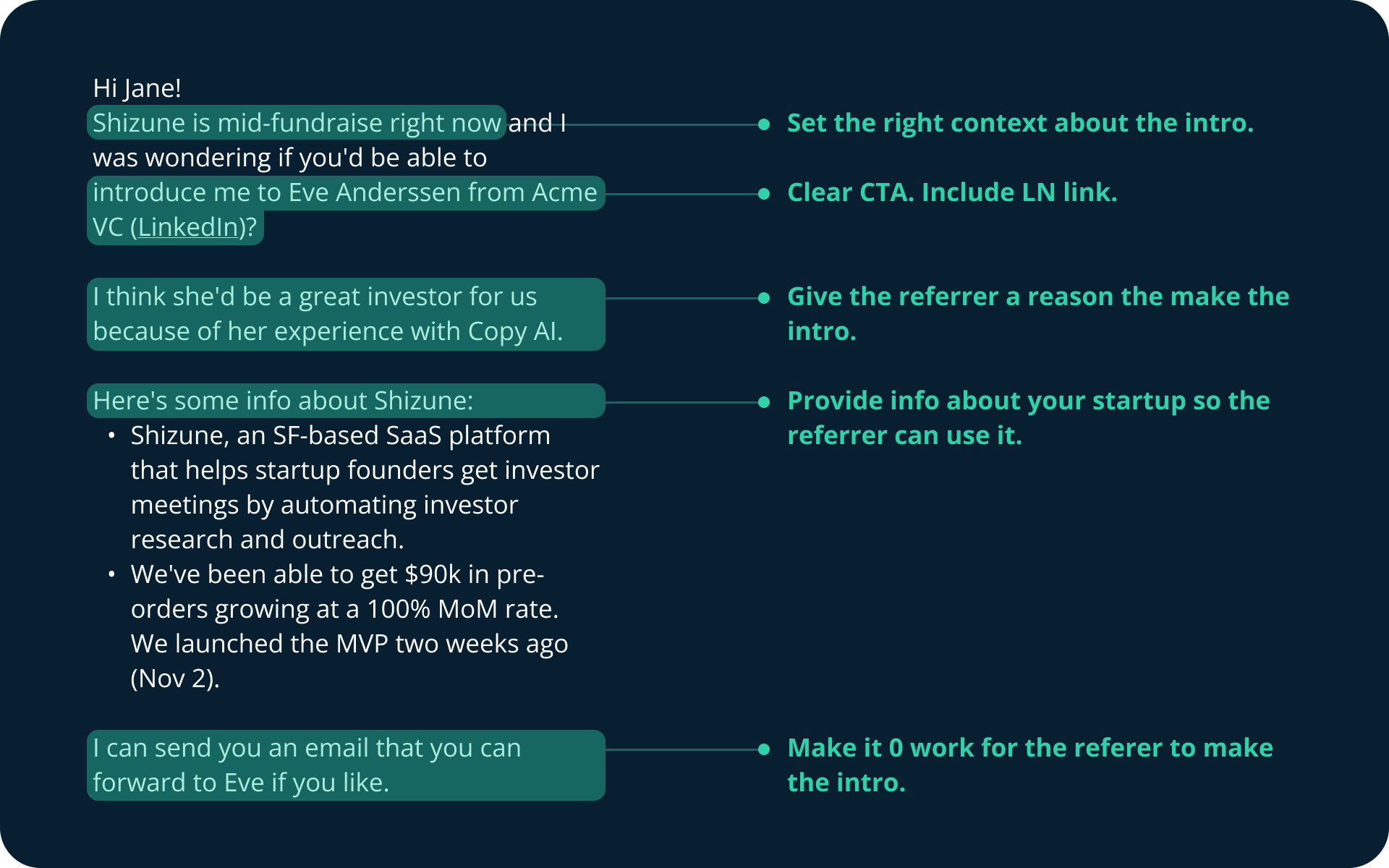

Writing tips:

- Tell an introducer that you're fundraising. It set's the right context for the intro.

- Ask for the intro to a specific investor (or investors). Include their names, companies, and LinkedIn links.

- Tell the introducer WHY do you think the investor will be interested in you. It gives your referrer a reason to make the intro.

- Introduce your company with a short blurb. Things to include in the blurb: what you do, traction, team, and fundraising details. Your referrer will need this info to make the intro.

- Offer a forwardable email. Eliminate the work of writing an email for your introducer to double the chances of getting the intro.

How to write a forwardable email?

The more your referrer needs to think and work on your intro, the fewer chances that she/he will make it. Write an email to the investor, so your referrer can forward it in one click.

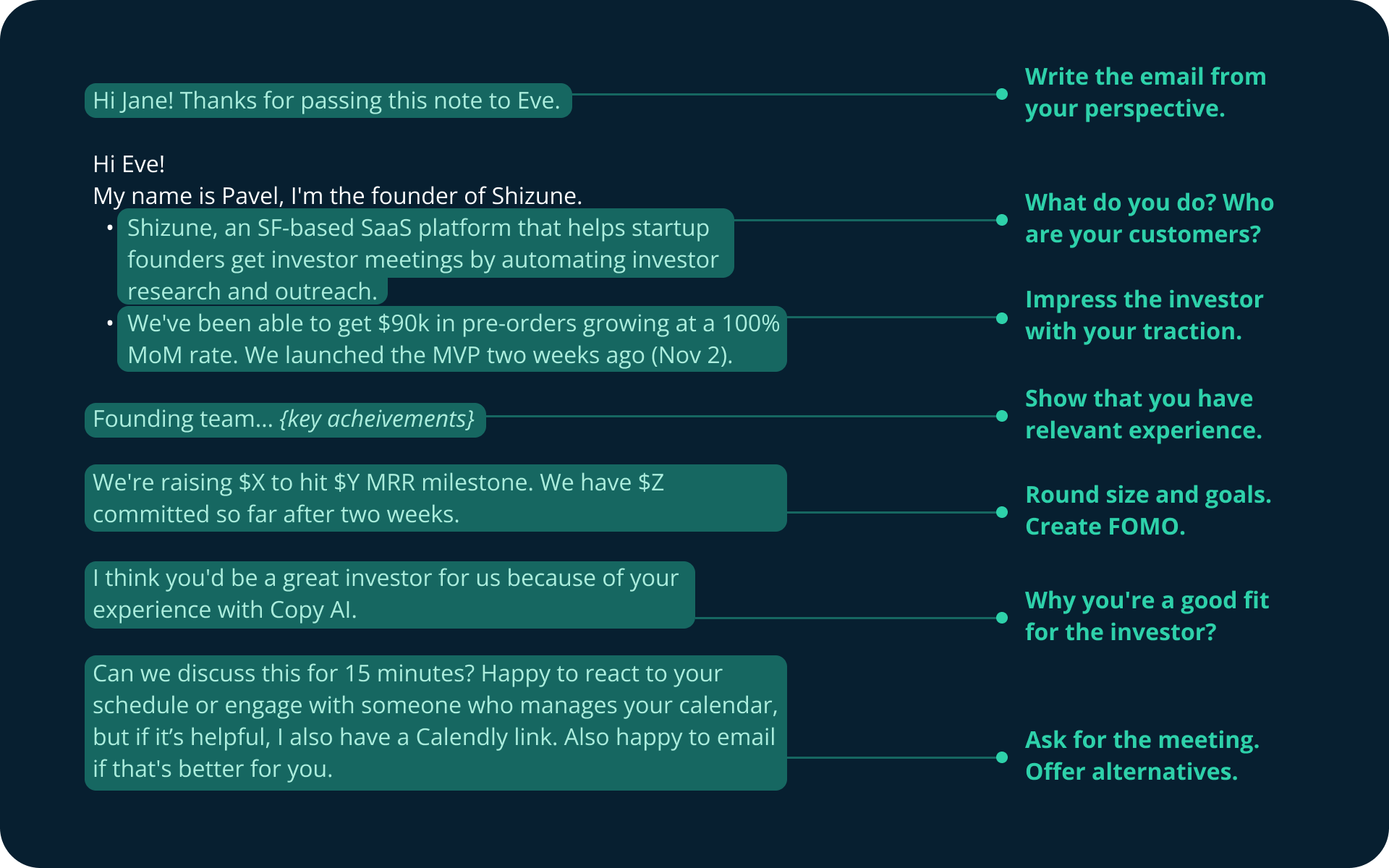

Writing tips:

- Write the email from your perspective, not from the referrer's perspective. It's your email to the investor. Thank the introducer and greet the investor.

- Introduce yourself and your company with a blurb. Read an article on how to write a great blurb here.

- Tell the investor WHY you think you're a great fit for him. Show the investor that you did your homework.

- Ask for a meeting gently. Ask for 15 mins, not 60. Make it easy to schedule the meeting by sharing your Calendly. Be very polite. Learn more about how to ask investors for a meeting here.

How to follow up?

You asked for an intro, the introducer agreed to make it and does not write back. What now? Well, we're all busy people and can forget things, so just follow up.

Be persistent. You need to close this round, and you need to do it quickly. Don't be afraid to follow up until you get the intro or get a No from the introducer.

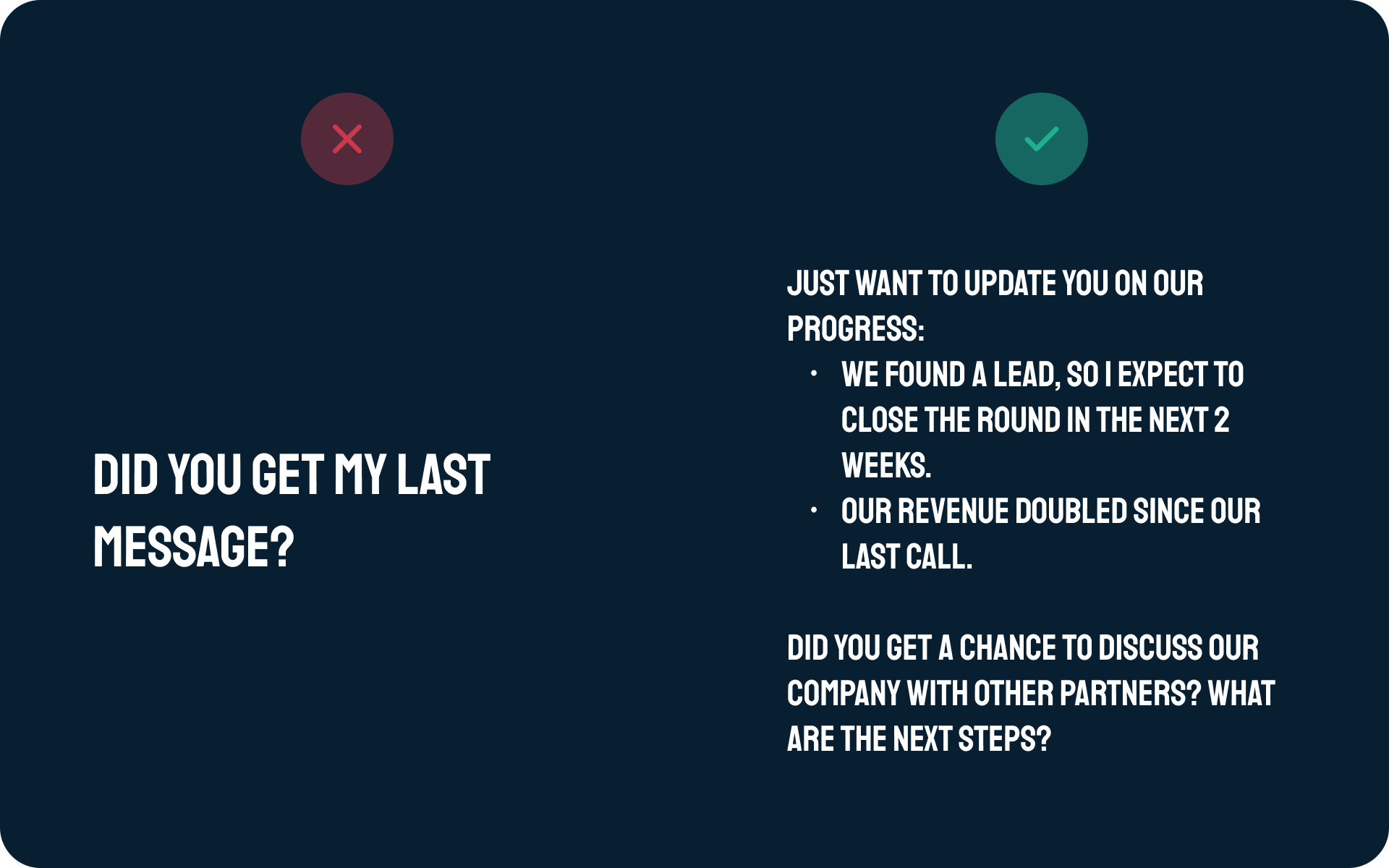

How to follow up with an investor?

Don't spam the investor with "Did you get my last message?" emails. It won't work. Each follow-up is a chance to provide a piece of valuable information to the investor, so use it wisely:

- Create urgency and FOMO. Always share something exciting. The most exciting things for investors are updates about your traction or funding progress.

- Have a clear call to action.

- Try different channels if the current channel doesn't work. But don't be creepy.

- Track email opens to understand what is happening.

Be thankful to your referrers

When referrers introduce you to investors they: a) do free work for you b) risk their reputation. The success of your fundraising is in the hand of your introducers. To be thankful to them and treat them well.

- Thank your referrer immediately after she/he made the intro.

- Thank your introducer again after you met with the investor. Even if the meeting went horrible for you.

How to get warm intros if you don't have a network of founders?

It's OK if you don't know a lot of people who can connect you with VCs. Just build your network from scratch.

There are a lot of strategies for growing your network, like attending events, joining communities, etc. I'll share my favorite ones that work remotely.

Strategy #1: Use networking platforms.

There are tens of platforms out there that match you with other founders. Meet 5-10 founders per week, and you'll have 40+ referrers in 4 weeks.

I use Potlach. I love it because you can browse community members and request meetings with anyone you like. They also have daily pitch sessions with VCs and AMA sessions with successful founders.

Strategy #2: Get to know founders in your industry

The previous method is great, but there are no guarantees that founders you meet will know relevant investors.

Reach out to the founders of relevant companies that are 1-2 steps ahead of you. They can give you some business advice and introduce you to their investors.

Putting it all together

How to get warm introductions to investors:

- Find introduction paths to an investor on LinkedIn. Top referrers: successful portfolio founders > your investors/advisors > people you know > people you don't know.

- Approach referrers with the "Can you introduce me to X?" type of ask. Make it as easy as possible for them to make the intro — send them your forwardable email.

- Follow up if needed. Thank your referrers for the intros.

- Approach your co-founders/investors/advisors with the "Do you know any relevant investors for me?" type of ask.

- Meet with relevant founders to grow your network.

Other tactical fundraising advice

Support

Whoa, this was a long one! Thanks for reading!

If you're feeling generous perhaps show some love to the thread on Twitter.

Comments ()