A step-by-step guide on how to build a list of investors for your startup.

The very first step to getting your startup funded is to find investors. But where to find angel investors and VCs (venture capital firms)? How to get investors for your business?

It's crucial to find investors who invest in your industry and at your stage. Reaching out to the wrong investors is a time waste — they won't fund your startup.

Below is a step-by-step guide on how to find investors fo your startup that will join your pre-seed or seed round.

The strategy to find the right investors

There are thousands of investors out there. You need to find the ones who invest in companies like yours. Researching them all will take months - what do you do?

A founder who raised $8mil. seed round shared his technique with me. Work backward.

How do you know whether an investor will join your funding round or not? She/he already invested in a similar company in the past.

3 steps to finding relevant investors

- Understand who is your ideal investor

- Find companies similar to your startup (same industry, same stage)

- Find their investors

Or you can skip this and let Shizune find investors for you:

Get 250+ investors tailored to your startup. Automatically.

Angels and VC funds that invest in your industry, stage, and geography. Trusted by 3,000+ startups.

Step 1. Understand who is your ideal investor

First of all, you need to understand what investors you're looking for. Who can add value to your company?

- Investor type. Who is your investor? Angels, VC funds, or both.

- Investment thesis. Where the investor invests (preferences in industry, verticals, business model ). Example: Healthcare, Fintech, SaaS, etc.

- Stage. Pre-Seed, Seed, Series A, and beyond.

- Geography.

Feel free to add your parameters.

Two main types of investors

Venture capital fund (VC fund) — a company that invests in startups professionally. People that make decisions about investments are called partners.

Angel investor — any individual that can invest in your company. Usually angels are successful entrepreneurs, top managers, or VC fund partners.

Who to choose: angels or VCs?

VC funds want to see more traction than angels. So if you're a pre-product/pre-revenue startup, then go for angels. If you have some revenue and growth to show off, then go for VC funds and angels.

Investment thesis/focus

Most investors have a strict list of industries they invest in (investment thesis). Just write down the industries relevant to your company.

It will help you to find investors that have a deep understanding of your market and can add value to your startup.

Stage

- Pre-Seed funding. For companies at a pre-revenue/pre-product stage. Most VCs won't invest at this stage, so focus on angels.

- Seed funding. For companies that are getting their first revenue. Both angels and VCs actively investing at this stage.

- Series A funding and beyond. For companies that found their product/market fit (link).

You can learn more about startup funding stages here.

If you can't decide what stage you're in, check out these benchmarks (one, two)

Geography

It's about the country of incorporation. But pay attention that usually investors prefer to invest in their home country.

Step 2. Find startups with relevant investors

You probably already have a list of competitors and companies operating in your industry.

Find 100-120 startups who operate in your industry or have a similar business model. They have investors who will be interested in joining your round.

Why 100? Based on my data, that usually converts into a list of 100-150 relevant investors, which is just enough to close a seed round.

How to find startups with relevant investors?

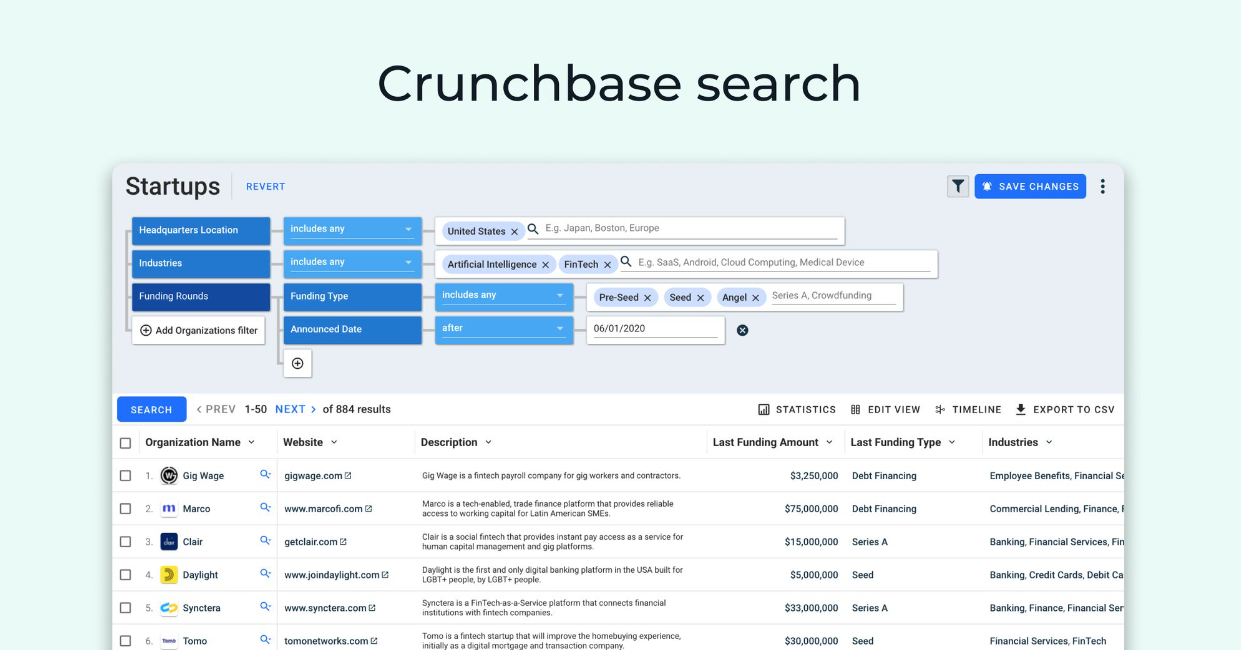

You can use any platform like Linkedin or Angellist, but I prefer Crunchbase. They have great filters, plus they offer a 7-day trial period. That's enough to finish the list :)

Open Crunchbase, go to Query builder, and apply filters just like on a screenshot. Use your ideal investor profile to fill in the values.

Apply the "Announced date" filter to filter inactive investors.

Manually pick the most relevant startups from the list and save them to your Notion.

Step 3. Find Investors

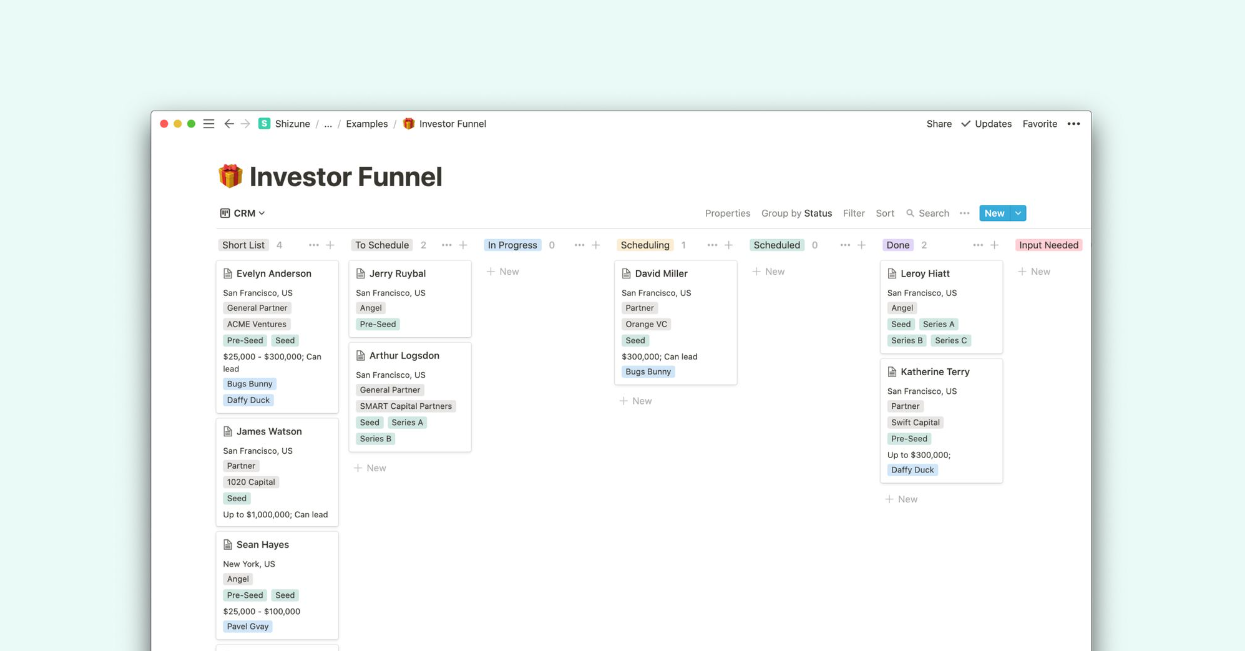

Now turn your list of startups into a list of investors.

- Open the company on Crunchbase and Angellist.

- Look through all investors.

- Save the best ones.

Repeat these steps for all startups that you saved to Notion.

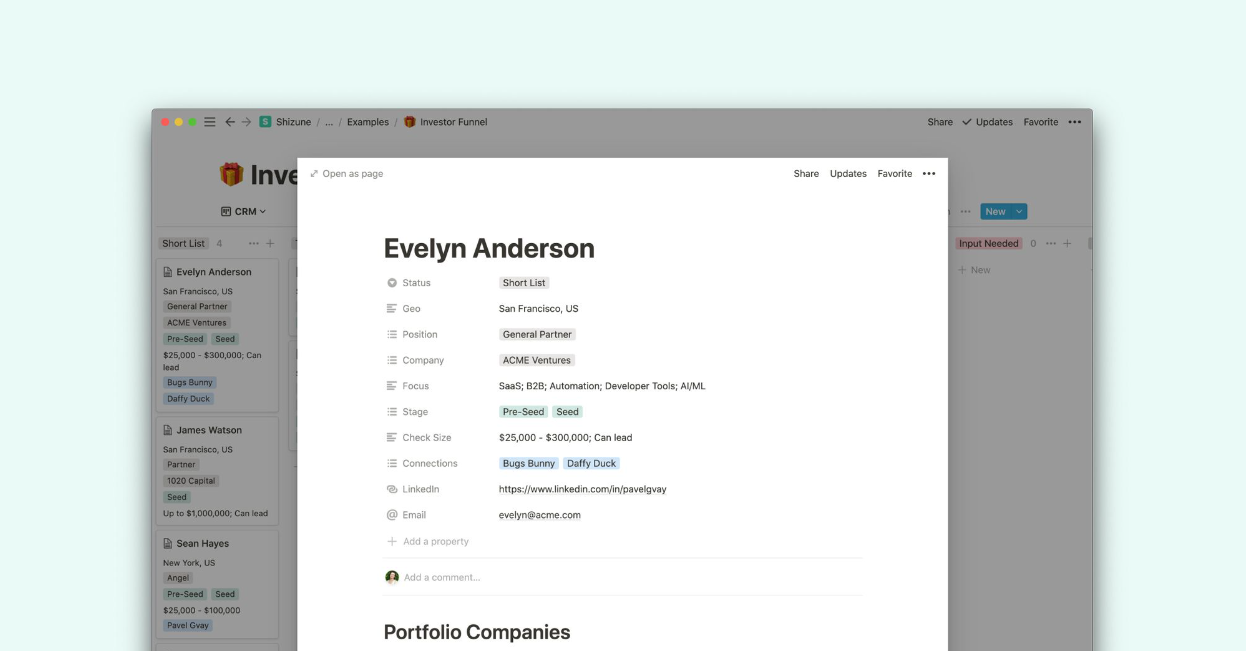

Gather as much valuable information about each investor as possible. You're going to need it later to write a perfect cold email or ask for an intro.

Things to look for:

- General info: name, city, position, company.

- Relevant investments.

- Work history.

- Interesting social network posts/blog posts.

- Contact info: email, social network links.

- Mutual connections on LinkedIn.

When researching VC funds, always find the most relevant partner. Otherwise, you won't know who to reach out to.

How to get investors for your startup?

You've built your investor pipeline. Now it's time to connect with investors.

There are only two ways of connecting with an investor:

- Warm. Ask someone to introduce you to an investor.

- Cold. Send a cold email or message.

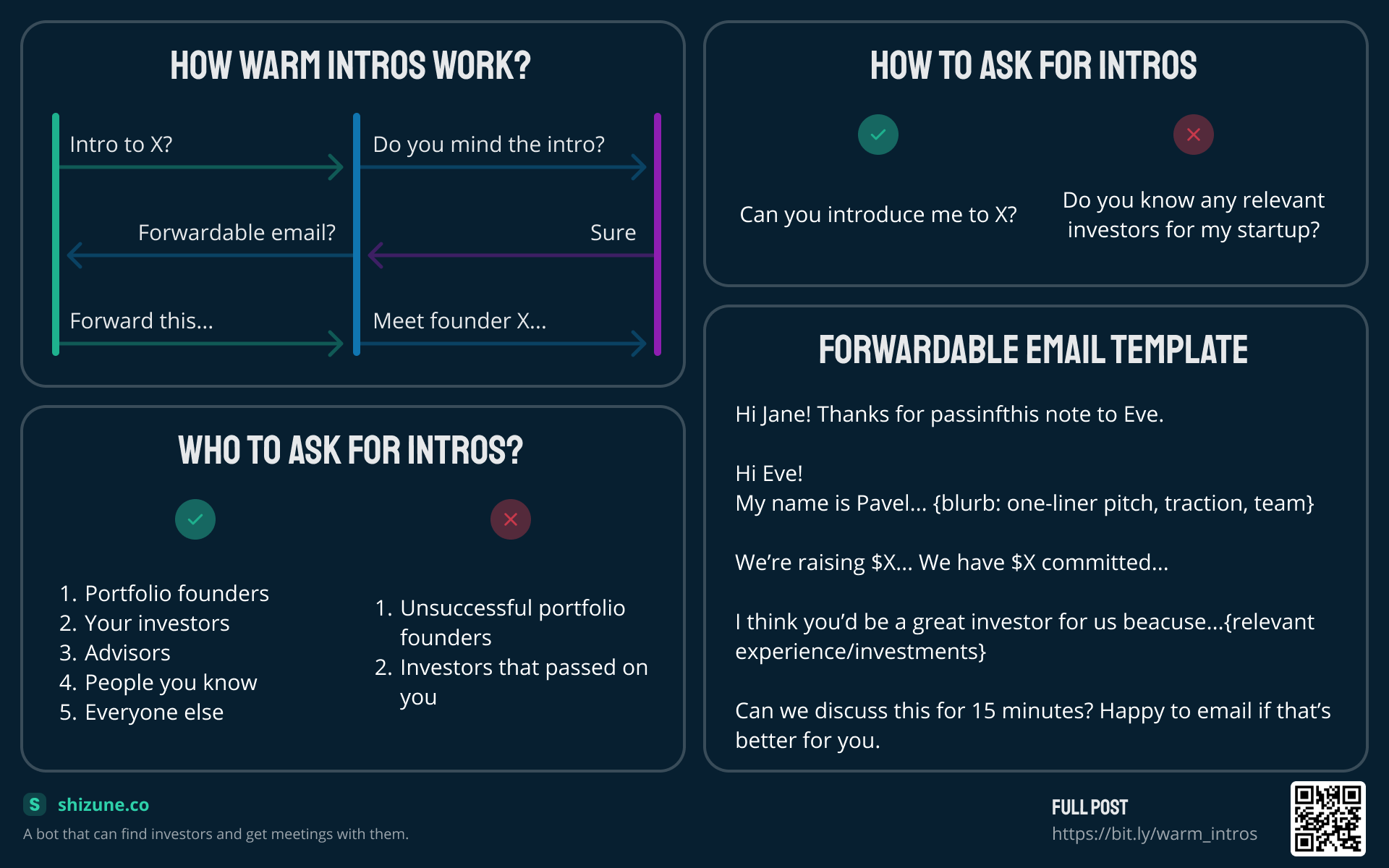

How to get warm introductions to investors?

- Who to ask for intros: portfolio startup founders, your investors/advisors.

- Where to find introducers: check for mutual connections with investors on Linkedin.

- Always approach your referrers with "Can you introduce me to X?, not "Do you know any relevant investors for my startup?".

- Introduce your company the right way.

Most investors prefer warm intros, so you should always try to get it if possible.

I wrote a post on how to get warm introductions to investors. Check it out for warm introduction email templates and advanced advice.

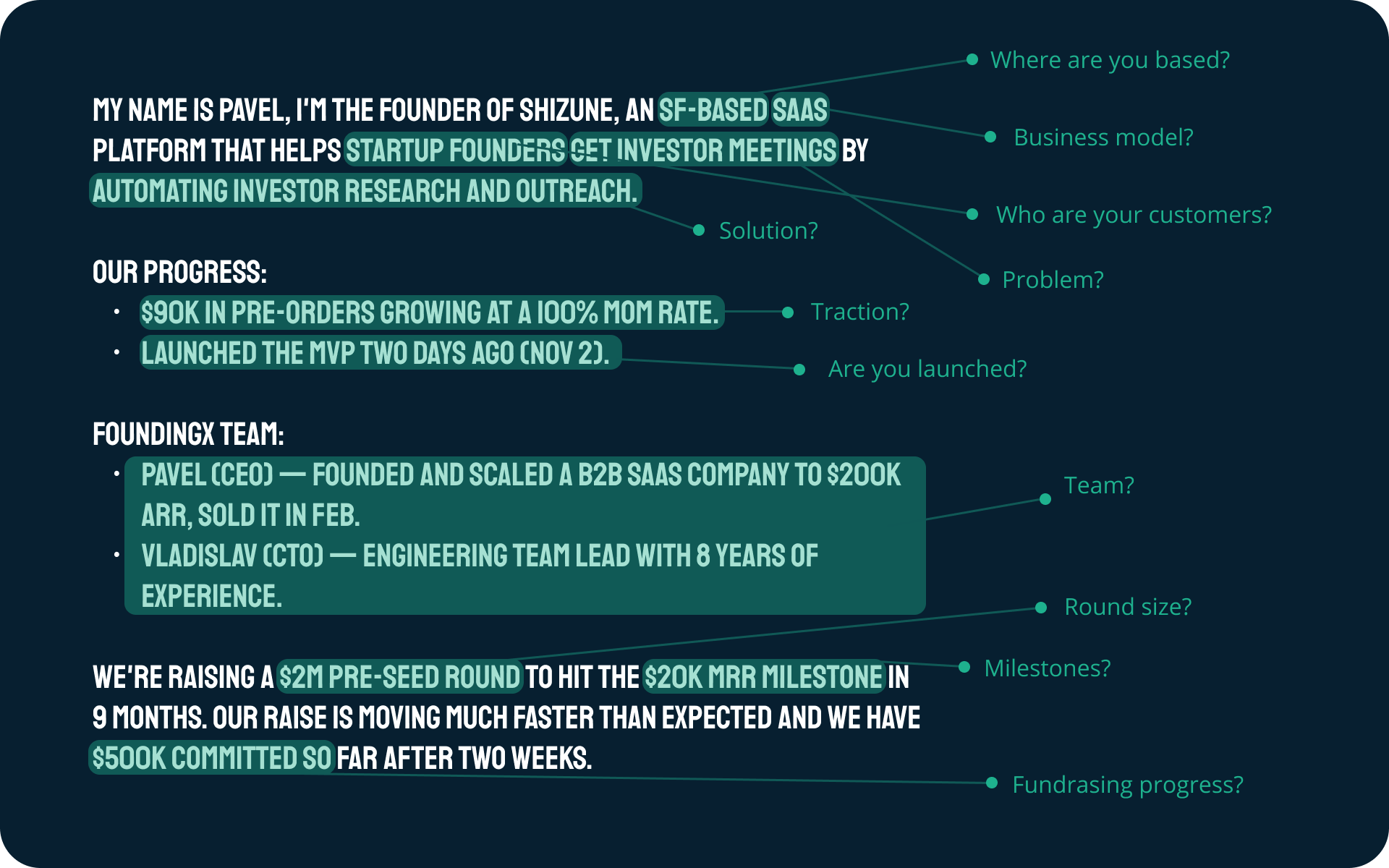

How to cold email investors?

Fact: you can get funded through a cold email. But you need to do it right

- Subject: catchy one-liner pitch

- Opening lines: why do you think the investor is a great fit for you.

- Body: what do you do, who are your customers, traction, team, and fundraising progress.

- Wrap up your email with an ask for 15-min meeting.

Keep your email short, <30 seconds to read it.

Rule №1: Do not send the same template email to all investors, it won't work. Investors are immune to template emails. Use the info you found on each investor to personalize your emails.

Check out my post on how to cold email investors. Cold email templates inside.

Putting it all together

How to get investors for a startup online:

- Identify who is your ideal investor. Angel or VC; industries; stage; geo.

- Find startups in your industry and at your stage. They might have relevant investors.

- Find investors of the startups. Use Crunchbase and Anglelist to research them.

- Connect with the investors via warm introductions and cold emails.

Or you can let Shizune do it all for you:

Get 250+ investors tailored to your startup. Automatically.

Angels and VC funds that invest in your industry, stage, and geography. Trusted by 3,000+ startups.

More fundraising guides

- How to cold email investors?

- How to get warm introductions to investors?

- How to introduce your company to investors?

Support

Thanks for reading!

If you found it useful, please do share with your friends. I spent 30+ hours on this so it would be nice if a few people read it.

Subscribe to my Twitter for more fundraising hacks and guides.

Comments ()