Before building a deck

The deck is just a visualization of your narrative, so focus on your story first and then build a deck.

Before you start crafting your story, understand what are you pitching:

- Traction — create a fear of missing out on a high-growth startup.

- Team — make investors believe your team is uniquely capable of building a high-growth startup.

- Product / Technology — make investors believe you have a unique technology that may be capable of becoming a high-growth startup.

Not all investors like to go through decks at meetings, so also prepare:

- Live product demo

- FAQ

The process of building is ongoing:

- Tune the deck for different investors to match their backgrounds.

- Update the deck after meetings as you get more feedback.

- Add new slides to your appendix to answer questions investors ask you most frequently.

Do not spend too much time building an initial version of your deck. Get the first version done in one day and get feedback from your friends/advisors/friendly investors as soon as possible.

Format & Structure

Divide your deck into two parts:

- Pitch — your story. 2-3 minutes long maximum.

- Appendix — answers to frequently asked questions.

The sequence of slides might vary based on your industry and stage.

Technical parameters:

- Aspect ratio: 16:9

- Format: PDF

- Tools: Pitch, Beautiful, Google Slides, Keynote, PowerPoint.

- When sending your deck over email, use DocSend or BriefLink to track opens and engagement.

Design guide: How to design a pitch deck?

Pitch slides

Title

Describe what your company does and who are your customers as simple as possible, in fewer words possible.

Make sure investors understand what you do. They won't listen to your pitch if they don't understand it.

Traction

Showing off traction tells investors two things:

- People want what you build

- You know how to deliver your product to market

- Your product works

The metrics should be meaningful to your industry and stage. Example:

- Seed SaaS: MRR + Growth Rate + Retention

- Pre-Seed B2B: LOIs from big companies.

- Pre-Seed B2C: Huge and growing waitlist.

Problem

Clearly state the problem and how it affects people. Show the impact in numbers. Visualize it if possible.

Problem = demand = something real-world people are willing to pay for (ideally already paying).

Problem = something your competitors missed, and their users are unhappy about it. Ideally, they should be actively looking for a solution and the demand should be visible.

Solution / Product

Solution — what you're doing differently to solve the problem. Product — how you do it.

Show how your product makes the life of your users better (visually or in numbers). Describe your product and solution as simply as possible. Don't dive into technical details.

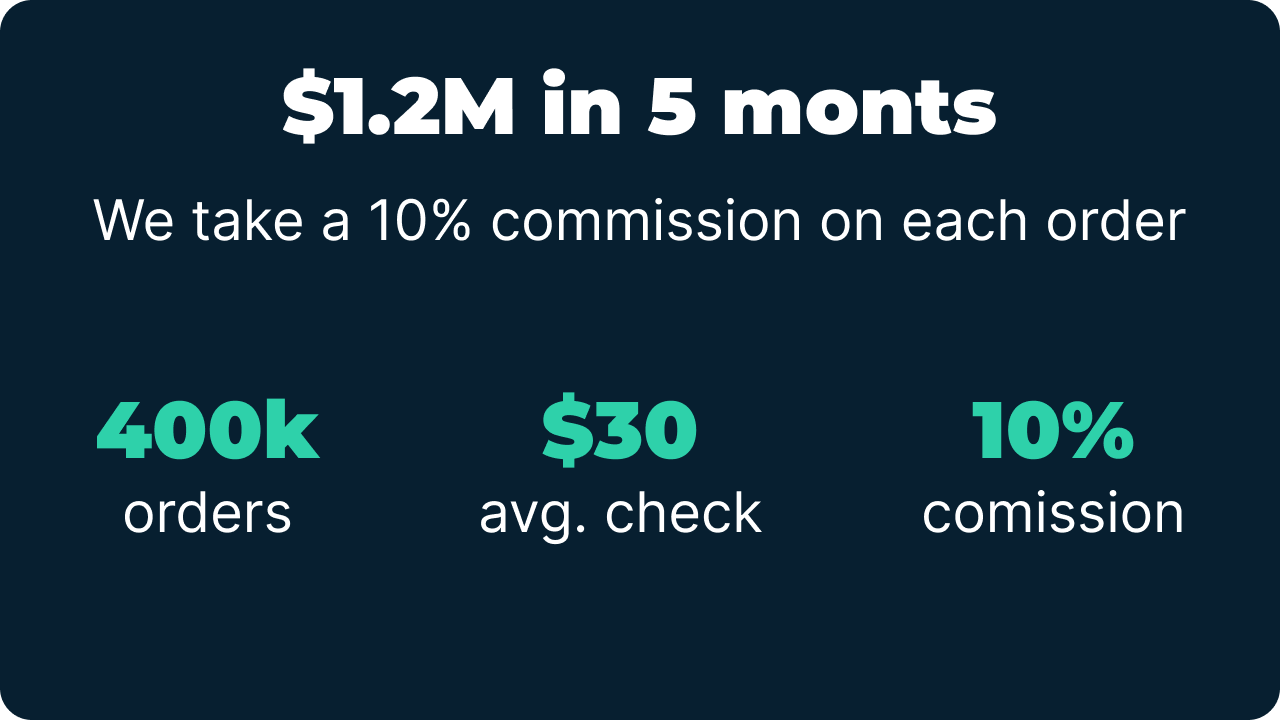

Business model

This is a key slide. Explain how you make money. Prove that your business model is working by showing real numbers.

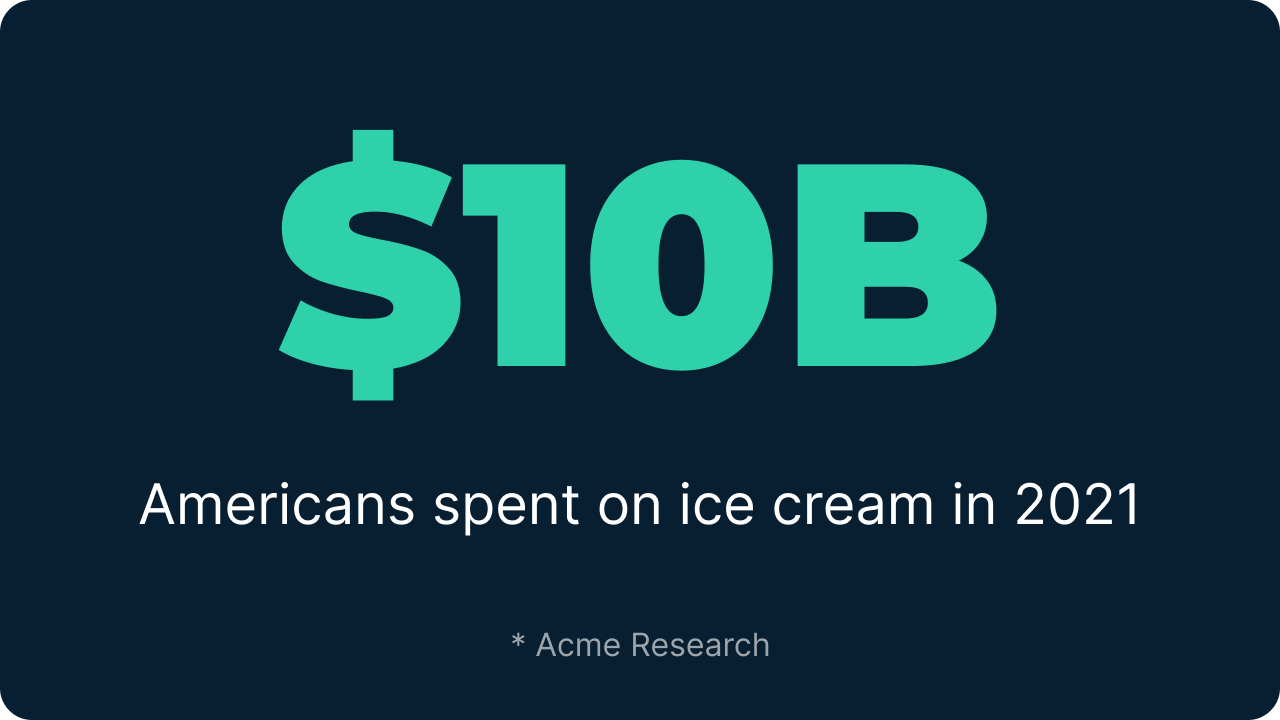

Market size

Show how big your company can become.

Two things that matter most about any market: size and growth (can be negative!).

- If you’re operating in a large market that’s going to die in 3 years, that’s bad.

- If you’re operating in a small but growing niche in a big market, that’s perfect.

Market size example: say you’re robbing a bank.

- TAM — All the money in the bank.

- SAM — Money in the room that you cracked.

- SOM — Money you were able to snatch.

Large TAM is great, but what matters most is SOM — money you can realistically make. Don't just say “We’ll capture 10% of X market”. Go bottom-up, explain how you’re going to do it.

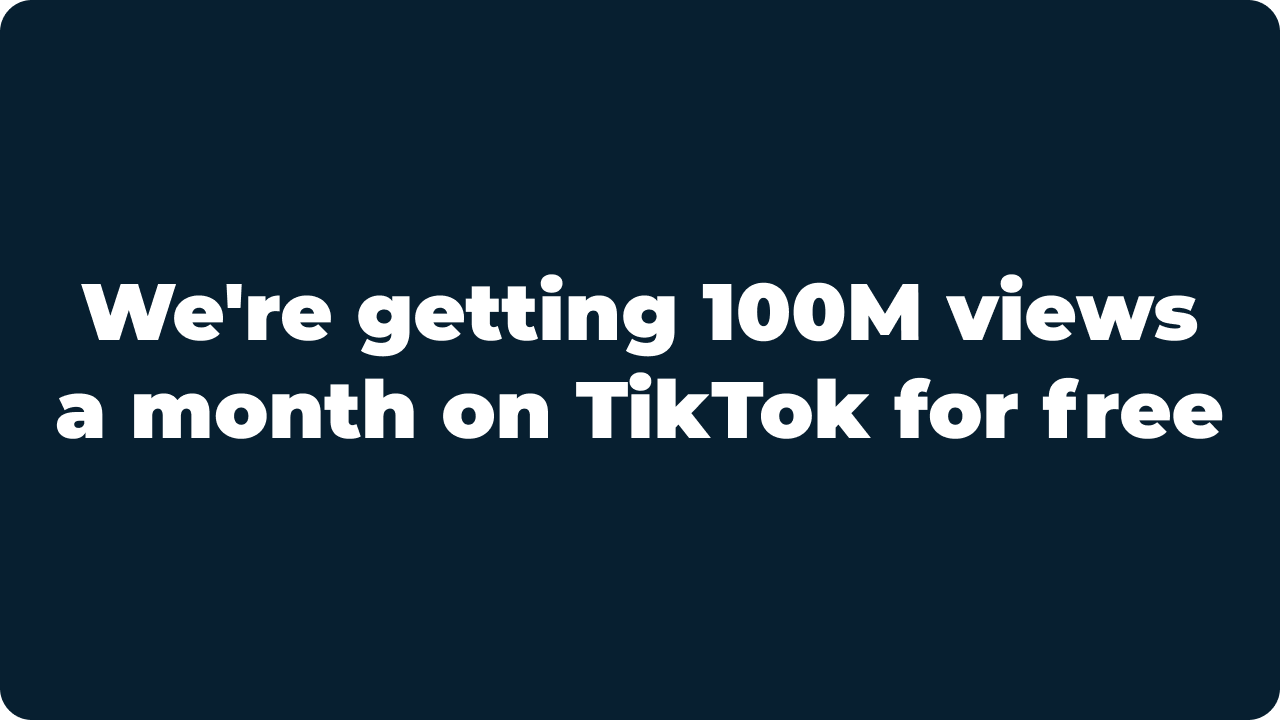

Secret sauce

Your unfair advantage. Something that makes you unique and your competitors can’t copy. It’s not usually about your technology, but about distribution.

Unfair advantage

- Patented AI algorithm

- A strong network effect

Not an unfair advantage

- Cool design

- Facebook ads campaign

Note that the strength of any advantage weakens over time. What once was an advantage becomes an industry standard. Drop-in audio chat was Clubhouse's advantage and now Twitter, Discord, and Telegram have it too. Check out the Kano model.

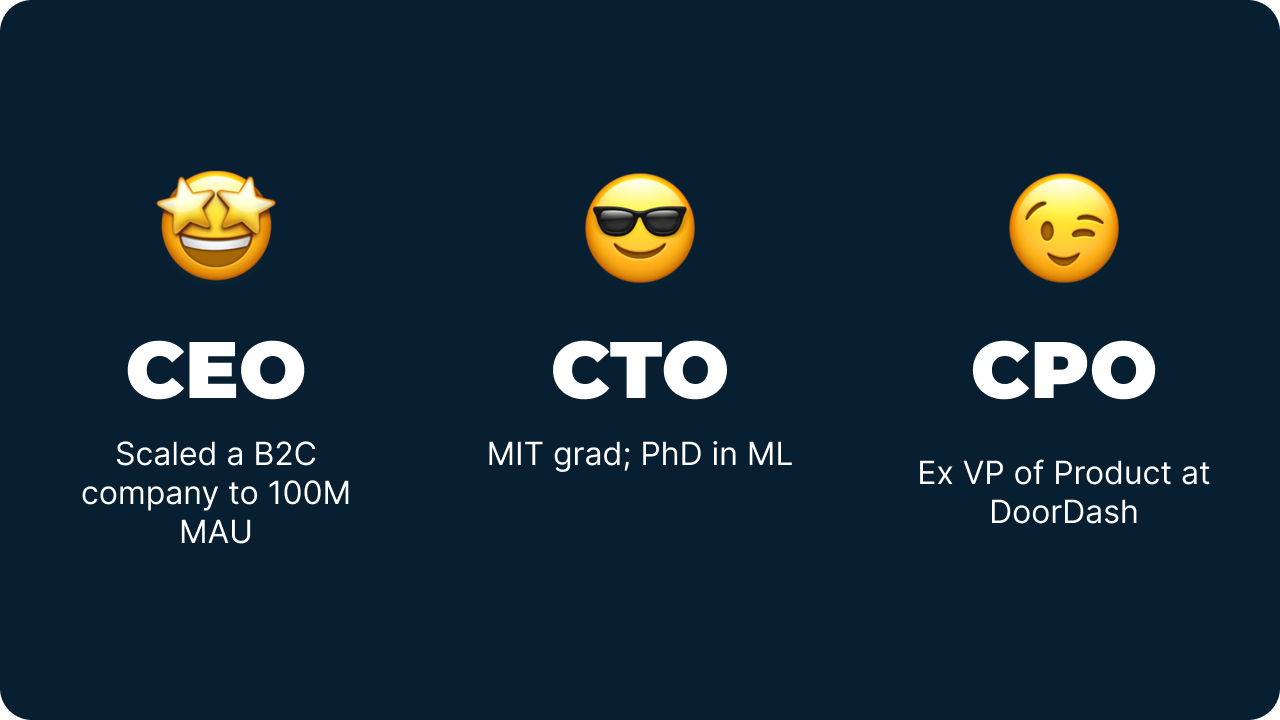

Team

Explain why your team is uniquely qualified to solve this problem.

Convince investors that you can build a world-class product, deliver it to the market and grow it into a multi-billion company.

Ask

Tell the investor how much money you need and what milestones you want to hit with them. Always have a "Use of funds" slide in your appendix in case the investor wants to dive deeper into this.

Wrap up

Stop your pitch at this slide. Summarize your pitch: what you do and traction.

Appendix

You need the appendix part of the deck to answer investors' questions. One slide = one investor question.

The most common appendix slides:

- Use of funds

- Financials

- Competition & Advantages

- Go to market

- Why now?

- Exit strategy

- Prodcut/traction/marketing/technical deep dive

Comments ()